Deal making & structuring

Section Menu

Pages in this section

About:

TREDIC Global Property Development

TREDIC Development:

TREDIC Investment:

Deal Making & Structuring

Professional Services:

Active Global Markets

TREDIC Global Property Development

Joint Ventures & Partnerships:

Infrastructure:

Contact TREDIC:

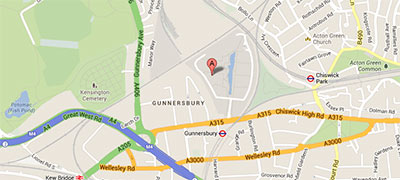

Location:

TREDIC Corporation

Tel: +44 (0) 203 997 7945

TREDIC Head Office:

Building 3, Chiswick Park,

566 Chiswick High Road,

Chiswick,

London,

W4 5YA,

United Kingdom.

‣ Careers

‣ Location Map: TREDIC London Headquaters

Deal making & structuring relates to how TREDIC operate, how we evaluate and execute development & investment opportunities, how we work with our partners and clients, and how we prefer to structure real estate transactions.

Formalising relationships:

Prior to any client or partner work being undertaken, any project analysis or any due diligence; TREDIC requires its commercial interests, intellectual property & investment relationships to be protected, and the parameters for the nature of the professional relationship to be agreed in writing. Typically this is executed through the signing of a mutual collaboration agreement with a specific focus on confidentiality, non-disclosure and non-circumvention.

Market entry:

TREDIC typically enter new markets through one of four possible routes. These include: advisory partnerships, internal team partnerships, development management partnerships or full joint venture partnerships. To learn more, please visit our Partnerships and Joint Ventures page:

Costs:

In almost all client & early stage partner relationships TREDIC requires its costs to be covered, and will typically incur professional fees during the due diligence, analysis, feasibility and investor relations stages of the development. To learn more about TREDIC’s operations, please visit our Development, Investment & Professional Services pages:

Asset Classes:

TREDIC’s preference has traditionally been for Class A development & investment opportunities, including but not limited to the following asset classes: Mix use development, master-planned development, residential, commercial, retail, hotels and resorts, golfing, storage warehousing & logistics, healthcare and data centres. We also have an affordable housing solution for emerging, high risk and developed markets and with our membership of BREEAM and USGBC, we have a passion for sustainability and green build. Ultimately we take each client and partner engagement opportunity on its merits. To learn more about the sectors that TREDIC serve, please visit our Industry Sectors page:

Ownership preference:

TREDIC will consider each deal on its merit. On development deals where we are pure delivery and management agents for a client we will charge a fixed percentage fee with bonus structure; in scenarios where TREDIC are originating deal flow, risking seed capital and simply seeking an equity and debt partner, then TREDIC will take a strong ownership position and equity percentage.

Joint Ventures (JV’s):

TREDIC will consider all types of joint venture development & investment either on behalf of our own capital or as an investment adviser and development manager. We are historically a fee earning, joint venture special purpose vehicle (SPV) developer but we are increasingly investing time, effort and funds into our own and 3rd party JV projects with partners. To learn more, please visit our Partnerships and Joint Ventures page:

Local influence:

Partners and clients in emerging and high risk markets generally bring local influence, capital & banking relationships, connections within local municipalities, and the ability to push through approvals & permits and to provide the infrastructure through which TREDIC will operate. When TREDIC operates on behalf of clients entering these markets, TREDIC manages this process internally, or sources the relevant partner in the host country through which we will execute the project.

Engagement terms:

For development projects TREDIC prefers full development management i.e. to manage the 5 key sectors of the development process: 1. feasibility, 2. pre development management, 3. construction & build, 4. post development management & 5. exit. When our investment or advisory expertise is called upon to manage a specific section of the development process then we carefully analyse our partner’s situation and the host market complexities before determining the best, most risk adverse and most profitable outcome for both parties. To learn more, please visit our development page:

Financing Development:

TREDIC invests self equity into our own projects and some 3rd party JV projects but typically we source the majority of project finance through our global investor relationships, including: banks, funds, private equity, government, high net worth, investment trusts, family offices, investment syndicate and alternative asset finance. To learn more about investment and financing, please visit our investment page:

Location:

TREDIC operate globally and domestically within the UK and we will consider all international development & investment opportunities, from commercial development to infrastructure. TREDIC’s core strength and long term strategic plans are focussed on emerging and high risk growth markets. We currently have commercial interests across Europe, Middle East & Africa, Central & South East Asia, Russia and CIS and most recently Latin America. To learn more, please visit our Global markets page:

Project Size:

TREDIC will develop projects ranging from bespoke single & ultra-luxury residential dwellings, to mix-use master-planned communities. Our preference is always for great projects, with trusted partners yielding strong returns and projected IRR’s. In terms of advisory, TREDIC consult small medium enterprise, family offices, high net worth individuals, corporates and government bodies.

Small business partnerships:

TREDIC established a small business development and partnership philosophy in the first quarter of 2012 in order to undertake portfolio management work on lower value capital projects with family offices, small businesses and private wealth. Our first client engagement was in January 2012 and involved a full strategic analysis and investment sale of a portfolio of assets ranging from £1.5m to £35m GBP. It has been highly important for TREDIC to focus on growing this philosophy as smaller high net worth clients are the fastest growing client base within emerging and domestic markets. Our clients are highly demanding and expect a tailored and bespoke service with 24 hour access to TREDIC’s management function and database. TREDIC has been very quick to capitalise on this growing opportunity and to development key international relationships; particularly in the MENA, Russia & CIS and Central Asian regions. To learn more, please visit our Partnerships and Joint Ventures page:

Turnkey projects:

Regardless of size or industry sector, TREDIC will partner with end-user operators or investor buyers to create, design and deliver strategic developments serving a specific purpose. Whether it is a single development opportunity such as a hotel, or an international roll-out programme for a private medical clinic chain, TREDIC will source the land, raise the funding and develop manage the turnkey project from start to finish.

TREDIC Corporation

Tel: +44 (0) 203 997 7945 Email: info@trediccorporation.com

Registered Address: TREDIC, Building 3, Chiswick Park, 566 Chiswick High Road,

Chiswick, London W4 5YA, United Kingdom.

Registered in England and Wales No. 07617700.

Social Links

© Copyright 2016 TREDIC Corporation. All rights reserved