Pre-development

Section Menu

Pages in this section

About:

TREDIC Global Property Development

TREDIC Development:

TREDIC Investment:

Deal Making & Structuring

Professional Services:

Active Global Markets

TREDIC Global Property Development

Joint Ventures & Partnerships:

Infrastructure:

Contact TREDIC:

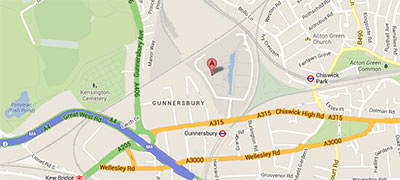

Location:

TREDIC Corporation

Tel: +44 (0) 203 997 7945

TREDIC Head Office:

Building 3, Chiswick Park,

566 Chiswick High Road,

Chiswick,

London,

W4 5YA,

United Kingdom.

‣ Careers

‣ Location Map: TREDIC London Headquaters

Pre development involves the management of the professional activities that TREDIC will execute to manage the project from the decision to develop the asset through to the start of the construction process. This includes the management of the project finances as well as its delivery.

TREDIC typically manages and leads the following professional activities:

1. Appointing a professional development team: TREDIC will short list, vet and appoint the professional delivery team, these include - architects, engineers, surveyors, bespoke consultants, cost & project managers. In many cases, TREDIC will undertake many of these activities in house. All team members will be required to have local knowledge or local partners.

2. Undertake detailed due diligence: Financial, technical, legal & environmental. This includes the following activities:

3. Managing the design process: To commence with, the architect needs to prepare a master plan of the site and a conceptual scheme. In order to select the best architect, TREDIC may choose to organise a paid for architectural competition, or vet and select a number of trusted architects that we know have the capability to deliver such a project, and present these to the client.

4. Occupier search & selection: Once the conceptuals are produced, TREDIC will undertake a comprehensive occupier search and selection exercise. This is the process of short listing, negotiating with and selecting the tenants and / or investors of choice for the project.

5. Cost Management: The cost manager will need to provide preliminary costings for the project based on the concept. TREDIC will appoint and oversee the commercial activities of the cost manager, or undertake these activities in house, with the best interests of the project at hand.

6. Preparing a business plan & investment memorandum: Typically TREDIC will gather a full detailed information due diligence package on the opportunity before structuring the investment or placement memorandum as follows:

• Cover & contents.

• Executive summary of the opportunity.

• Development manager (TREDIC) introduction.

• Introduction to the principal, history, track record & ownership structure.

• Full project introduction, history, current ownership structure & due diligence.

• Finances (equity & debt) committed so far.

• Investment required and use of funds (proposed split of debt & equity).

• Preferred terms of commercial engagement & the proposed / potential deal structure, both financially & from a delivery perspective.

• Projected development & investment time-frames.

• Exit strategy.

• Funding security (what collateral if any are we offering the investor i.e. a monthly or quarterly return on equity)?

• Investment risks (& mitigates)

• Next steps.

• What is the potential for future business together an incoming investor? Are there other development opportunities for investment in the pipeline?

7. Raising development finance (debt, equity, mezzanine) – The process of marketing the project to select potential co-investors for equity funding, and to banks for the debt funding. Potential investors will have already been short-listed for approach as soon as the decision to progress with the project is made. TREDIC may engage the services of a specific capital markets adviser on this front, which serves both the technical requirements, but also allows for external accountability and the ability to access a comprehensive funding network.

8. Schematic & detailed design, ongoing cost management: The designers, now in liaison with the chosen operator and planning authorities will design the schematics and detailed design of the building. The cost managers will monitor closely the costs, and TREDIC will monitor and coordinate all professional activities.

9. Securing the necessary building permits: The architect will work closely with TREDIC and if required, a local project manager to secure the permits to start the construction process.

10. Closing on development & construction finance: Seed finance will have typically covered the professional fees to date. Once the building permits have been secured this will release equity and debt for the construction and build programme into typically a joint venture special purpose vehicle (JV SPV), between TREDIC’s client (the principal) and the chosen funding partner.

11. Buying the land: If the land is not yet purchased then the option agreement to purchase (which will typically have been negotiated between the land owner and the principal at the project assembly stage as a “subject to” gaining building permits offer) will be enacted and the land will be purchased. If the land was already purchased at the assembly stage, then the land will now be sold into the JV SPV with the benefit of the uplift in land value associated with now having the building permits. TREDIC’s partner or client should have more than covered the cost of the seed financing by this stage and should even be in profit.

Associated professional fees: This is the most expensive part of the development process in terms of professional fees. Typically 10-12% of the gross development cost will be incurred during this phase, but under a Turnkey Contract, TREDIC will commercially engage all sub-contractors as part of a fixed price or variable offering.

TREDIC Corporation

Tel: +44 (0) 203 997 7945 Email: info@trediccorporation.com

Registered Address: TREDIC, Building 3, Chiswick Park, 566 Chiswick High Road,

Chiswick, London W4 5YA, United Kingdom.

Registered in England and Wales No. 07617700.

Social Links

© Copyright 2016 TREDIC Corporation. All rights reserved