Investment process

Section Menu

Pages in this section

About:

TREDIC Global Property Development

TREDIC Development:

TREDIC Investment:

Deal Making & Structuring

Professional Services:

Active Global Markets

TREDIC Global Property Development

Joint Ventures & Partnerships:

Infrastructure:

Contact TREDIC:

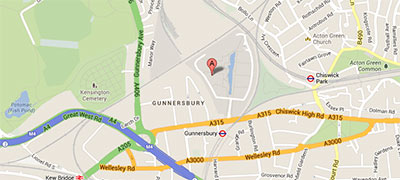

Location:

TREDIC Corporation

Tel: +44 (0) 203 997 7945

TREDIC Head Office:

Building 3, Chiswick Park,

566 Chiswick High Road,

Chiswick,

London,

W4 5YA,

United Kingdom.

‣ Careers

‣ Location Map: TREDIC London Headquaters

Whether TREDIC are invited as potential financing partners ourselves using TREDIC equity, or whether we are requested to act as funding & capital markets advisers, we typically adopt the following process for evaluating and executing project finance:

1. Protection of interests: TREDIC will require a NDA (non disclosure agreement), a TEL (terms of engagement letter), and a legally binding mandate agreement and contract. This must be to be agreed to, formalised and signed in advance of any professional activity.

2. Due diligence: The development project has to be analysed in depth, and the full project history, status, design and data reports need to be examined, broken into their constituent parts, and a due diligence list will be prepared and distributed to TREDIC’s partner or client.

3. Deal analysis: The due diligence pack is used to analyse the investment potential of the development project; its potential risks and returns, the potential pitfalls, the potential areas to add value and the amount of work that is still required to bring the project to a stage where it is ready to be financed.

4. Deal structuring: Once the due diligence has been satisfactorily analysed, a deal structure must be formalised and the project information available must be summarised and reduced into a financing, investment or placement memorandum.

5. Preparation of the memorandum: This varies from project to project but typically includes an: Executive summary, owner introduction, sponsor introduction, project introduction, track record & professional background, investment required and use of funds, preferred terms of engagement, loan terms and exit strategy, loan security & collateral, list of investment risks, growth opportunities, projected time-frame for investment & a list of the next steps & contact information.

6. TREDIC’S financing interest: TREDIC will evaluate the opportunity for its own potential investment purposes, and identify suitable 3rd party potential investors to either finance TREDIC directly if we wish to proceed, or finance our client directly if we do not wish to proceed. Should TREDIC wish to proceed, then we will often execute a lockout & option to purchase agreement. Should we not proceed, then 3rd party investors will be distributed with the finance memorandum and expressions of interest will be sought. Should we not wish to proceed; professional fees will be incurred by the client for TREDIC’s investment advisory services.

7. Third party financing interest: TREDIC will determine serious financing interest, facilitate meetings & briefings, and undertake any further necessary investor due diligence, provide TREDIC’s client with introductions to the potential financing partner and provide any ongoing updates to the finance memorandum. The memorandum will be tailored to specific investors and geared towards the specific deal structure, including a sensitivity analysis on the performance criteria of the project if required.

8. Deal execution: TREDIC will continue to act as investment advisor to our client and ensure any deal negotiated with the financing partner is done so on commercially viable terms, represents value for investment, and suitably matches risk exposure to return. We will then hand over final financing negotiations and deal execution to our client’s legal advisor’s.

9. Project & development management: It is not a necessity or pre-requisite of any investment engagement, but TREDIC always seek to position the business as the full development manager on behalf of our client, to ensure the successful financial delivery of the development.

TREDIC Corporation

Tel: +44 (0) 203 997 7945 Email: info@trediccorporation.com

Registered Address: TREDIC, Building 3, Chiswick Park, 566 Chiswick High Road,

Chiswick, London W4 5YA, United Kingdom.

Registered in England and Wales No. 07617700.

Social Links

© Copyright 2016 TREDIC Corporation. All rights reserved