Exit strategy & investment sale

Section Menu

Pages in this section

About:

TREDIC Global Property Development

TREDIC Development:

TREDIC Investment:

Deal Making & Structuring

Professional Services:

Active Global Markets

TREDIC Global Property Development

Joint Ventures & Partnerships:

Infrastructure:

Contact TREDIC:

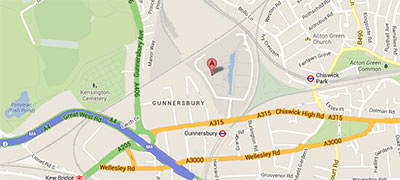

Location:

TREDIC Corporation

Tel: +44 (0) 203 997 7945

TREDIC Head Office:

Building 3, Chiswick Park,

566 Chiswick High Road,

Chiswick,

London,

W4 5YA,

United Kingdom.

‣ Careers

‣ Location Map: TREDIC London Headquaters

TREDIC’s greatest post development strength is the strategy creation and implementation of the investment sale process, managed by our investor relations team. TREDIC will assemble a full due diligence package on the investment opportunity, create the most applicable deal structure, design an offering memorandum and target a long list of investors. Ultimately we successful execute and manage the full sale process.

TREDIC typically manages and leads the following professional activities:

1. Exit strategy – TREDIC’s property exit planning service involves strategising with our partners and clients to determine if exiting from their property or portfolio is indeed the right decision and if it is, how and when they decide to do it whilst maximizing value, minimizing risks and preserving wealth. The benefits of a proactive exit plan include attracting a greater diversity of investment buyer, realising a higher sales price, paying less in taxes, and smoothly managing the transfer of ownership process.

Initial dialogue focuses on our partners and clients long term objectives and the feasibility of achieving them.

We carefully review:

1. The exit strategy alternatives available.

2. The business and / or commercial case for selling.

3. Due diligence on the property or portfolio in question.

4. The macro & micro economic market conditions.

5. The categories of investor suitable for the asset and what their objectives are.

6. How best to market and present the exit as an attractive investment.

7. Terms of non-disclosure and how confidential the exit is.

8. What other professional advisory services might our partner or client require?

With the above information to hand, TREDIC will advise its clients and partners on:

1. What the most appropriate exit strategy is.

2. What the initial market valuation for the asset is.

3. How to increase the asset valuation through financial engineering, and:

4. Increasing the amount the asset can sell for, through:

5. Managing the full investment sale process.

6. De-risking the investment from an investors perspective

7. Increasing the marketability and presentation of the asset.

8. Attracting a greater diversity of investment buyer.

9. Maintaining high levels of discretion and confidentiality.

10. Prudent taxation advisory.

11. Ensuring business continuity and managing the seamless transfer of ownership.

12. Preventing costly and avoidable mistakes through careful planning and due diligence.

As with all our advisory services TREDIC approaches the sale of property assets and portfolio’s as a carefully managed process and not as a sudden necessary event. Stable well managed assets command higher valuations and in turn require less investor due diligence and lead to simpler more straightforward transactions.

2. Investment sale process – If the exit strategy determined between TREDIC and our partners & clients is indeed one of investment sale then TREDIC will actively advise them in respect of the full range of exit options. We advise all classifications of real estate owner and investor from high net worth individuals to family offices and institutional investors.

The strength and depth of our international network means we have very strong links with global investors and are ideally placed to dispose of properties using our cross border network and market intelligence.

TREDIC may well have acted as development manager on the asset, or we may have participated as an adviser during the earlier stages of the development process, if not and TREDIC are invited by a client to purely act as an investment sale broker then TREDIC will undertake a full due diligence exercise on the asset and will present an investor memorandum structured as follows:

• Cover page

• Marketing page

• Contents page

• Foreword (Chairman’s letter & introduction)

• Executive summary

• Investment location & maps

• Investment fact sheet & financials

• Site plan & photographs

• Due diligence question & answer

• Next steps & the acquisition process

• Contact information

3. Due diligence - Due diligence on the investment asset is an incredibly important part of the investment sale process. TREDIC advise on the necessary due diligence both from the vendors and investors perspective:

Provision of said items should be provided by the vendor:

• What is the current owners preferred method of sale?

• Title deeds to the property.

• Last five years financials, profit & loss statements – demonstrating monthly returns. For hotels, this should include occupancy and average rates as well as capital expenditures.

• Any future projections of budgets.

• Current year to date profit & loss statement.

• For commercial premises, the terms of the leasing & tenancy schedule of accommodation.

• For hotel premises, the terms of the hotel management agreement; how is it managed, by whom and under what terms?

• Written confirmation that there are no legal disputes over the land and / or building and details of any administrative action or litigation threatened or pending against the asset.

• Written confirmation that the asset is free of all encumbrances, including debt obligations and 3rd party liabilities.

• Provision of any independent consultancy reports, including land & valuation reports and any market study reports, environmental, engineering reports and marketing plans.

• Full asset inventory – to be independently verified.

• Copies of any additional service contracts, leases, franchises, licenses, permits and any other contract or financial burden that the purchaser is expected to assume.

• Copies of all trademarks, trade names and copyrights.

• Property tax bills for the last three years.

• Schedule of all insurance coverage, including cost and expiration.

• Written confirmation that there are no rights of way of easements over the land on which the asset sits.

• What warranties will be provided?

• Current list of employees associated with the asset, including name, position, salary and benefits.

• For hotels, the full details of the hotels contracted F&B suppliers, including costs and contractual expiration.

• For hotels, the provision of any correspondence with tour operators that confirms their interest in the hotel subject to it securing an alcohol license.

• For hotels, can the hotel secure an alcohol license if it doesn’t already have one? Will this be secured by the current ownership as part of the deal?

• For hotels, a list of future reservations and bookings, including name of party, deposit received, rate guaranteed dates and status.

Provision of said items should be undertaken by the investor:

• Financial Audit – An independent audit performed by an accountant or firm with experience of executing transactions within the asset classification.

• Building inspection - An engineering & building surveying due diligence report which will include a check list that all mechanical & electrical systems work properly and the building structure is safe and secure. In addition the report might and preferably would include water & sewerage, drainage, telephone systems, computer systems, elevator systems, security systems & mechanisms and items of decor.

• Environmental inspection – A detailed inspection made by a qualified environmental engineer to disclose any potential environmental hazards that may exist on or within the property site.

• Legal verification – An investigation by a skilled local lawyer into all the properties contracts, licenses, permits, franchises (if any) and other documents to determine any potential adverse provisions and whether they can be transferred from vendor to investor.

• Title search – This should be provided by the vendor but the investor should still undertake a review of the various factors that could affect the title to the property; this search should be performed by the same local lawyer.

• Property tax verification – This involves a search into the current status of the tax assessment imposed on the asset. When an investment property is sold, the local taxing jurisdiction is likely to investigate the terms of the sale and possibly adjust the property’s assessed value upward to reflect the sale price. A new assessed value could adversely affect the property’s future cash flow. A property tax verification performed by a knowledgeable property tax consultant will provide an accurate estimate of future tax liabilities. The property tax consultant can also assist in minimizing an upward adjustment made by the assessor.

4. Concluding the sale - The closing of real estate investment sales involve the actual transfer of title of the asset from the existing owner (vendor) to the investor. When the investor assumes management, the closing may coincide with the takeover by a new tenant or operator.

The parties that are normally present at a closing include:

• Vendor and vendor’s lawyer

• Investor and investor’s lawyer

• Lender and lender’s lawyer (if relevant)

• TREDIC Corporation

The activities that take place at a closing include (1) accounting to allocate and prorate the property’s revenues and expenses and (2) a physical inventory of all the assets included in the purchase price. Any items to be transferred that are not included in the purchase price must be inventoried and valued in accordance with the terms of the purchase and sale contract.

After the necessary allocations and proration are calculated the relevant paperwork is signed and the requisite moneys are transferred among the parties.

Once this process is concluded, the purchaser holds title to the property.

TREDIC Corporation

Tel: +44 (0) 203 997 7945 Email: info@trediccorporation.com

Registered Address: TREDIC, Building 3, Chiswick Park, 566 Chiswick High Road,

Chiswick, London W4 5YA, United Kingdom.

Registered in England and Wales No. 07617700.

Social Links

© Copyright 2016 TREDIC Corporation. All rights reserved